Shares in offshore marine company Baker Technology Ltd jumped as much as 20 percent to a one-month high after a Singapore court ruled in its favour in a lawsuit.

Baker Technology shares were 14.6 percent higher at S$0.315, with over 6 million shares traded. This was 14 times its average daily volume over the last five sessions.

Singapore's high court dismissed a lawsuit filed by rigbuilder Sembcorp Marine Ltd to stop Baker from selling a stake in PPL Shipyard to a consortium of buyers including Yangzijiang Shipbuilding (Holdings) Ltd.

"With the conclusion of the lawsuit, and barring a successful appeal by SembMarine, Baker would finally be able to recognise a deferred gain of S$58.2 million from the sale of PPL Holdings," said DMG & Partners in a note.

This would lift Baker's net tangible assets per share by 8 Singapore cents to S$0.32, the broker said.

To read related story click

0951 (0151 GMT)

(Reporting by Charmian Kok in Singapore; charmian.kok@thomsonreuters.com)

************************************************************

8:49 STOCKS NEWS SINGAPORE-Index futures down 0.6 pct

Singapore index futures were 0.6 percent lower, indicating a weaker start for the benchmark Straits Times Index .

Asian shares eased on Friday, with China's factory activity data and a U.S. jobs report due later in the session making investors cautious as the escalating euro zone debt crisis threatened to further undermine growth worldwide.

To read related story click

(Reporting by Charmian Kok in Singapore; charmian.kok@thomsonreuters.com) (Editing by Michael Perry)

World stocks up tepidly as traders brush off woes - Yahoo Finance

BANGKOK (AP) -- Asian stocks struggled for firm footing Friday as investor nerves were tested by fizzling economic growth in China, but European markets headed higher as traders kept fingers crossed that Greece would avoid financial chaos.

Italian Premier Mario Monti's comment Thursday that Greece was likely to stay in the euro currency union helped buoy Europe markets, said Stan Shamu of IG Markets in Melbourne in an email. But he added that "perhaps we are just really tired of hearing how bad things are and just needed something to uplift."

In any event, European markets headed higher. Britain's FTSE 100 rose 0.5 percent to 5,376.35. Germany's DAX rose 1.1 percent to 6,384.10 and France's CAC-40 added 0.9 percent to 3,064.09.

Wall Street appeared set for a higher open, with Dow Jones industrial futures rising 0.2 percent to 12,558 and S&P 500 futures gaining 0.3 percent to 1,326.20.

Earlier in Asia, however, gains were stanched by media reports that some of China's biggest banks will miss their annual lending targets for the first time in seven years, analysts said. Hesitation to take out loans suggests companies are delaying investment due to uncertainty about the economic outlook.

Japan's Nikkei 225 index rose 0.2 percent to 8,580.39. Hong Kong's Hang Seng gained 0.3 percent to 18,713.41 and South Korea's Kospi added 0.5 percent to 1,824.17.

But Australia's S&P/ASX 200 shed 0.7 percent to 4,029.20. Benchmarks in mainland China, Singapore, Taiwan, Indonesia and New Zealand also fell.

Chinese economic growth fell to a nearly three-year low of 8.1 percent in the first quarter and factory output in April grew at its slowest pace since the 2008 crisis, raising the threat of job losses and possible political tensions.

On Thursday, a private survey of Chinese manufacturers showed activity weakened further in May.

Peng Yunliang, a Shanghai-based analyst, said the reading was "worse than expected and contributed to the loss" among mainland Chinese shares. The Shanghai Composite Index fell 0.7 percent to 2,333.55 while the Shenzhen Composite Index lost 1.2 percent to 935.05.

Worries were also to the fore in Europe, where seven of the 17 countries that use the euro currency are in recession. Greece will go bankrupt shortly without an international bailout and could exit the euro — a financial event that could harm bigger troubled economies like Spain and destabilize Europe's banks.

Despite potentially disastrous outcomes, European leaders failed to find an agreement on how to fix the financial crisis at their latest summit Thursday.

Among unresolved issues was whether euro countries should issue a collective bond. That would allow every country to borrow funds at the same rate, substantially lowering the costs for the more indebted countries. But Germany, the biggest euro economy, opposes the idea.

"One solution maybe the joint euro bond but of course Germany is against it," said Francis Lun, managing director of Lyncean Holdings in Hong Kong. "And with disagreement in Europe, I doubt the EU's ability to solve its current problem. So, I think that is the uncertainty that everybody is worried about."

The likelihood of Greece leaving the euro has been growing since early May, when political parties opposed to the terms of the country's financial rescue deprived pro-austerity parties of a majority at the polls. New elections are planned for next month.

A Greek election on June 17 could see anti-bailout political parties gain power, which would raise the likelihood of the country leaving the euro.

Among individual stocks, Japan Tobacco Inc. jumped 5.2 percent a day after announcing an agreement to buy all shares in Belgian tobacco maker Gryson NV this year, news reports said. Japanese retailer Fast Retailing Co., owner of the Uniqlo casual clothing stores, rose 2.4 percent.

But Japanese export shares fell on concerns that a stronger yen will hurt profits.

Sony Corp. sank 4.5 percent and Sharp Corp. lost 1 percent.

Benchmark oil for July delivery was down 45 cents to $91.11 a barrel in electronic trading on the New York Mercantile Exchange. The contract rose 76 cents to settle at $90.66 in New York on Thursday.

In currencies, the euro rose to $1.2591 from $1.2525 late Thursday in New York. The dollar fell to 79.51 yen from 79.58 yen.

Citigroup, Other Big Banks Didn't Learn Much From The Financial Crisis, New Report Suggests - Huffington Post

What did big banks learn after the mammoth bailouts of the financial crisis?

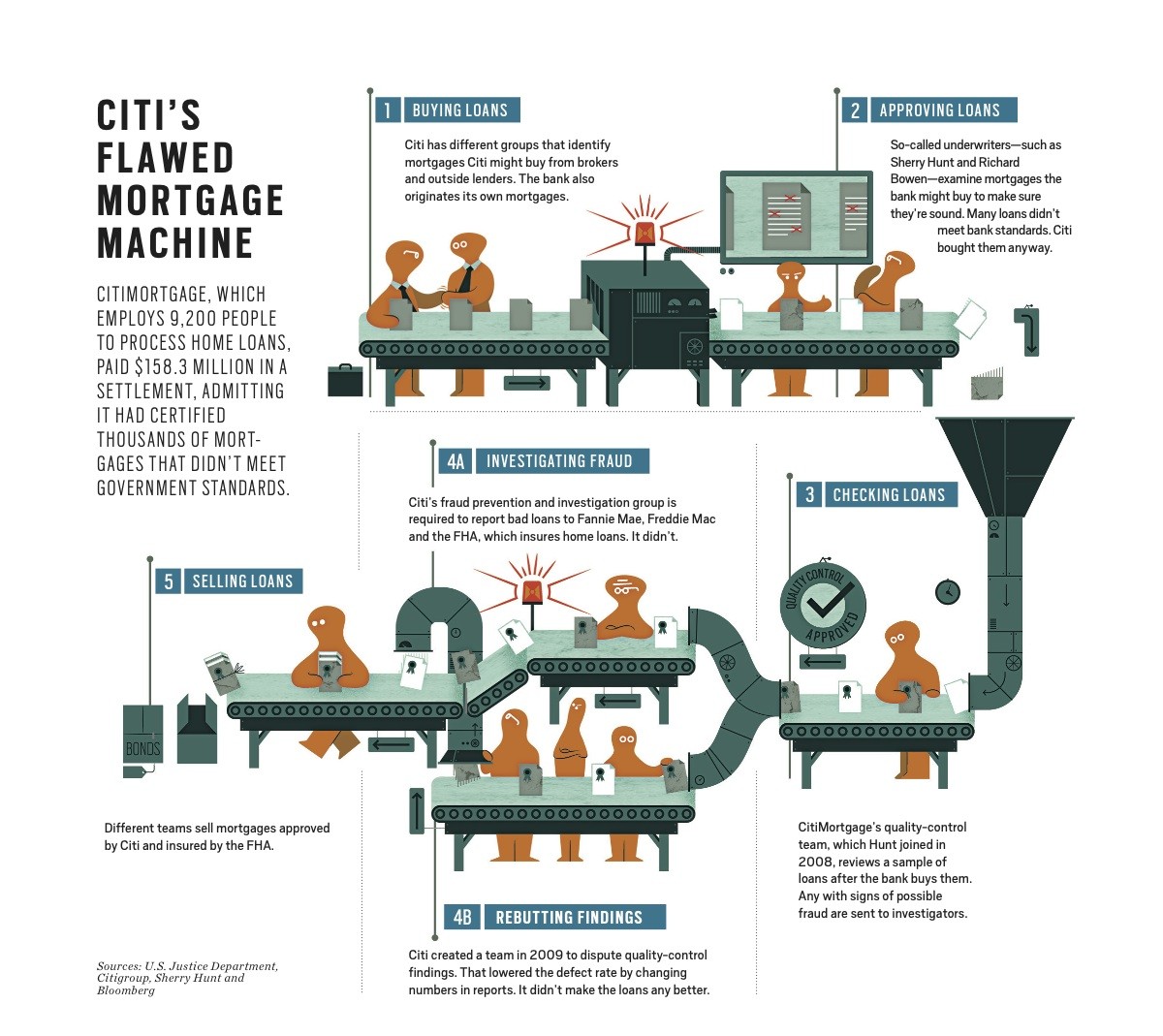

Why, not that much it seems. That's one powerful takeaway from Bloomberg reporter Bob Ivry's tale of a whistleblower awarded $31 million for exposing widespread fraud at Citibank's mortgage unit. The wrongdoing, which Citi admitted to in a February settlement with the U.S. Justice Department, took place long after the financial giant paid back billions of dollars in bailout money from the U.S. government and Federal Reserve.

Read the full report from Bloomberg Markets here.

Citi knowingly misled the federal government into insuring thousands of risky mortgages, costing taxpayers nearly $200 million, the Justice Department claimed. This took place "before, during and after the financial crisis, and even into 2012," Ivry writes in the latest issue of Bloomberg Markets magazine.

Sherry Hunt a senior manager at the bank responsible for spotting fraudulent mortgages spurred the Justice Department to action when she sued Citigroup last year. The feds joined her case under the federal False Claims Act, which encourage whistleblowers by giving them a 25 percent cut of any court award. In February, Citigroup agreed to pay the government $158.3 million, admitting wrongdoing.

The number is just 1.4 percent of the company's 2011 net income, Ivry points out. Hunt's share before taxes and paying her lawyers: $31 million.

Like many other financial institutions during the housing boom, Citi got a little carried away with mortgages. The bank bought bad loans and then turned around and ignored Hunt's quality control group. In fact, the bank went so far as to create a team to dispute the findings of Hunt's team.

That's right, a team inside Citi would flag problematic loans and then another team would essentially de-flag them. The fraud went on long after the crisis.

Citigroup behaving badly as late as 2012 shows how a big bank hasn’t yet absorbed the lessons of the credit crisis despite billions of dollars in bailouts, says Neil Barofsky, former special inspector general of the Troubled Asset Relief Program. “This case demonstrates that the notion that the bailedout banks have somehow found God and have reformed their ways in the aftermath of the financial crisis is pure myth,” he says.

Hunt is the latest whistleblower to hit the jackpot. On Tuesday, lawyers for former real estate appraiser Kyle Lagow announced he would receive $14.5 million as part of a settlement announced in February between Bank of America Corp. and the Justice Department over claims of mortgage fraud at Countrywide, which was bought by BofA in 2008.

Check out a graphic from Bloomberg Markets detailing Citi's alleged mortgage fraud below:

STOCKS NEWS SINGAPORE-OCBC cuts Sakari to 'hold' - Reuters UK

OCBC Investment Research downgraded its rating on Singapore-listed Indonesian coal mining firm Sakari Resources Ltd to 'hold' from 'buy,' citing lower coal prices.

Shares of Sakari fell 1.38 percent to S$1.42 and have fallen 22.3 percent so far this year.

Sakari's share price has plunged about 32 percent since it reported first quarter results on April 30, underperforming the Straits Times Index's 8.6 percent fall in the same period.

Sakari's share price drop was partly due to its poor earnings in January-March and a continued fall in coal prices, said OCBC, and lowered its target price on the stock to S$1.45 from S$2.29.

The broker cut its coal price assumption by 10 percent to $76 per tonne, resulting in a 48 percent fall in its 2012 earnings forecast for Sakari.

"If coal prices continue to remain depressed or drift lower, this would further jeopardise the company's targeted average selling price of around $85-$90 per tonne for this year," OCBC said.

1017 (0217 GMT)

(Reporting by Leonard How in Singapore; leonard.how@thomsonreuters.com)

************************************************************

10:06 STOCKS NEWS SINGAPORE-Baker Tech surges on court ruling

Shares in offshore marine company Baker Technology Ltd jumped as much as 20 percent to a one-month high after a Singapore court ruled in its favour in a lawsuit.

Baker Technology shares were 14.6 percent higher at S$0.315, with over 6 million shares traded. This was 14 times its average daily volume over the last five sessions.

Singapore's high court dismissed a lawsuit filed by rigbuilder Sembcorp Marine Ltd to stop Baker from selling a stake in PPL Shipyard to a consortium of buyers including Yangzijiang Shipbuilding (Holdings) Ltd.

"With the conclusion of the lawsuit, and barring a successful appeal by SembMarine, Baker would finally be able to recognise a deferred gain of S$58.2 million from the sale of PPL Holdings," said DMG & Partners in a note.

This would lift Baker's net tangible assets per share by 8 Singapore cents to S$0.32, the broker said.

To read related story click

0951 (0151 GMT)

(Reporting by Charmian Kok in Singapore; charmian.kok@thomsonreuters.com)

************************************************************

08:49 STOCKS NEWS SINGAPORE-Index futures down 0.6 pct

Singapore index futures were 0.6 percent lower, indicating a weaker start for the benchmark Straits Times Index .

Asian shares eased on Friday, with China's factory activity data and a U.S. jobs report due later in the session making investors cautious as the escalating euro zone debt crisis threatened to further undermine growth worldwide.

To read related story click

(Reporting by Charmian Kok in Singapore; charmian.kok@thomsonreuters.com)

Stocks to watch at close on Thursday - businessday.com.au

AAP

Stocks to watch on the Australian stock exchange at close on Thursday:

BHP - BHP BILLITON LTD - down 20 cents at $31.97

Thousands of workers have ended a week-long strike at six Queensland coal mines but unions say more industrial action is likely.

DJS - DAVID JONES LTD - down four cents at $2.21

Sales at David Jones fell by about three per cent in the three months to April, and the retailer is gearing up for a big end of financial year clearance.

EGP - ECHO ENTERTAINMENT GROUP LTD - up six cents at $4.40

Echo Entertainment chairman John Story says he will fight attempts by billionaire James Packer to kick him out of his job.

FXJ - FAIRFAX MEDIA LTD - steady at 66.5 cents

Fairfax Media has been accused of making "easy instead of smart" cost-cutting decisions by outsourcing production jobs to New Zealand.

GMG - GOODMAN GROUP - down four cents at $3.38

Industrial property owner Goodman Group is set to expand into the United States markets.

MTS - METCASH LTD - down 11 cents at $3.82

Grocery wholesaler Metcash says it will dispute a $23.4 million charge arising from an audit by the tax office.

MYR - MYER HOLDINGS LTD - down 5.5 cents at $1.925

The head of department store chain Myer Holdings says the company can beat its online retail rivals by offering the best of worlds.

PBG - PACIFIC BRANDS LTD - up 0.5 cents at 55.5 cents

Chairman of embattled clothing retailer Pacific Brands James MacKenzie will step down from his post in June.

UGL - UGL LTD - up 15 cents at $12.08

QRN - QR NATIONAL LTD - up eight cents at $3.41

RIO - RIO TINTO LTD - down 49 cents at $56.86

Engineering firm UGL has won $190 million in contracts to supply and maintain freight locomotives for four different companies.

Stocks higher on housing but Europe worries linger - Yahoo Finance

NEW YORK (AP) -- Hopes that the U.S. housing market is starting to recover and the economy is on the mend sent stocks higher on Wall Street.

But the gains are being constricted from continuing worries that Greece's political deadlock could fracture the European Union and roil global markets.

The Dow Jones industrial average rose 75 points Wednesday to 12,707. The Standard & Poor's 500 added nine points to 1,340. The Nasdaq composite rose 15 points to 2,908.

Home builder stocks rose after the Commerce Department said builders started work on new homes at an annual pace of 717,000 last month, 2.6 percent more than in March. It was a heartening sign for the beleaguered housing market, which seems to be forming a bottom and starting to recover. Construction rose for both single-family homes and apartments.

Target Corp. rose after a strong earnings report. Target said revenue at stores opened at least a year rose 5.3 percent, the strongest performance in six years for that period. Target's results illustrate that Americans are beginning to spend cautiously as economic uncertainty persists. Though the job market is still shaky, falling gas prices have given shoppers hope.

As signs of a global economic slowdown persist, prices of commodities have come off highs. Oil prices continued their march downwards from $105 in the beginning of the month to $93. Crude oil prices were down $1 on Wednesday. Gold prices fell $18 to $1539, the lowest level since December.

In Europe, a potentially chaotic situation was developing in Greece, where power-sharing talks collapsed Tuesday and new elections were called for next month. There is already concern in other European countries about how a possible Greek exit from the euro would affect the rest of the continent.

On Wednesday, Spain's prime minister warned that the country, which is trembling under a 24.4 percent unemployment rate, could be locked out of international markets due to problems in the EU.

"Right now there is a serious risk that (investors) will not lend us money or they will do so at an astronomical rate," Mariano Rajoy told Spanish lawmakers.

Financial pressures extend well beyond Europe too. The Indian rupee hit a new all-time low against the dollar with investors increasingly seeking a safe place to put their money. The rupee sank to 54.44 against the dollar Wednesday, surpassing the prior low of 54.39 on December 15.

Among other stocks making big moves:

— JC Penney plunged 14 percent, the most in the S&P 500 index, after the retailer reported a bigger-than-expected first-quarter loss. Sales plummeted as shoppers are rejecting their new pricing plan.

— Abercrombie & Fitch fell 11 percent after reporting that its first-quarter net income shrank 88 percent because of higher costs and declining sales in established stores and in Europe.

— General Electric rose 3.6 percent, the most of the 30 stocks in the Dow, after the company said its finance unit will pay a special dividend of $4.5 billion to the parent company this year. It had suspended the payments in 2009 during a freeze in credit markets.

Global stocks investors head for exits - Financial Times

May 31, 2012 6:33 pm

Financial experts explain need for CBN autonomy - Vanguard

By BABAJIDE KOMOLAFE

FINANCIAL experts said that the autonomy of the Central Bank is a critical to macroeconomic growth and stability.

“The formal autonomy of the central bank is a pre-requisite for macroeconomic stability in Nigeria., said Samir Gadio, Emerging Markets Strategist, Standard Bank London.

Commenting on-going efforts to amend the CBN Act, he said, “There is such a wide consensus on this concept both in Nigeria and externally that one can only wonder about the real motivations behind the proposed bill to amend the CBN Act. If passed, the new legislation would be a major setback for the reform process and price stability…a setback of such magnitude that it is still unclear whether the authors of the bill genuinely want it to be adopted.

Unlike the present Act which makes the CBN governor as the chairman of the board and the Deputy governors as board members, the proposed amended CBN bill would provide for the appointment of a Chairman of the CBN Board (in reality a political appointee) and the exclusion of CBN Deputy Governors and Directors from the Board.

Annual budget

Also, the Board would include representatives of the Ministry of Finance and the Accountant-General of the Federation. Furthermore, the bill seeks to divest the Board of the power to consider and approve the annual budget of the central bank.

“Generally, we (RenCap) think all central banks across the world, not just the CBN, should be independent so that they are not influenced in terms of policy direction,” said Yvonne Mhango , Vice President, Sub-Saharan Africa Economist, Renaissance Capital (RenCap)

“You have the government that has the treasury under their management and controls fiscal policy. Fiscal policy in Africa is a stronger policy tool than the monetary policy and the reason is because monetary policy is a blunt instrument. This is because the transmission mechanism between the financial market and the real economy is very weak.

“So, the government has the fiscal policy and monetary policy should be left for the CBN which should be independent. In Africa, I don’t see why there should be significant appetite to control monetary policy.”

Vice Chairman and Chief Executive Officer, Ancoria Investment and Securities Limited, Dr. Olusola Dada, also said that all over the world, central banks are independent. Dada advised that the CBN Act should not be amended such that the apex bank will be reporting to the ministry of finance, insisting that the Bank ought to report directly to the Presidency.

“In this era of globalisation, Nigeria cannot afford not to follow the global trend. A truly independent and autonomous CBN has become more imperative for the integration of our financial system with the world economy in general and the West African sub region in particular..

“What is required now is not to erode the financial autonomy of the CBN but rather to build and strengthen relationships that would enhance complementary role between the monetary and the fiscal authorities, and ensure accountability and transparency,” he added.”

Stocks Trade Narrowly Mixed; FB Below $27 - CNBC

Stocks closed lower Thursday with all three major averages logging their worst May since 2010, driven by mounting concerns over the euro zone debt crisis in addition to worries over a slowing U.S. economy.

Meanwhile, Facebook [FB Loading... () ![]() ] recovered to close near $30 a share after dipping below $27 earlier in the session. Meanwhile, S&P Capital IQ lowered its price target on the social networking giant to $27 from $30.

] recovered to close near $30 a share after dipping below $27 earlier in the session. Meanwhile, S&P Capital IQ lowered its price target on the social networking giant to $27 from $30.

The Dow Jones Industrial Average slipped 26.41 points, or 0.21 percent, to close at 12,393.45. Caterpillar [CAT Loading... () ![]() ] led the laggards, while BofA [BAC Loading... ()

] led the laggards, while BofA [BAC Loading... () ![]() ] gained. The blue-chip index failed to log a two-day win streak this month.

] gained. The blue-chip index failed to log a two-day win streak this month.

The S&P 500 dipped 2.99 points, or 0.23 percent, to end at 1,310.33. The Nasdaq slid 10.02 points, or 0.35 percent, to finish at 2,827.34.

For the month, the Dow and the S&P 500 dropped more than 6 percent, while the Nasdaq plunged nearly 7 percent. The Dow and Nasdaq posted their worst monthly declines since May 2010, while the S&P posted its biggest one-month drop since last September.

The CBOE Volatility Index, widely considered the best gauge of fear in the market, slipped below 24.

Among the key S&P sectors, techs closed lower, while financials climbed.

Stocks started the session lower following a batch of dismal economic reports but cut their losses around noon after a report that the IMF was in talks to provide a rescue loan to Spain. However, the IMF quickly denied the report and said the annual economic talks between the IMF and Spanish authorities will take place next week.

“We’re far from seeing any clarity from Europe, [but] central banks in general are helping to limit our downside,” said Rebecca Patterson, chief market strategist of JPMorgan Asset Management. “[Still,] we need better economic data, Greece resolved and I don’t see any of that happening in the short term.”

On the economic front, weekly jobless claims gained for the fourth-straight week, according to the Labor Department. And the U.S. economy grew at a slower pace than expected in the first quarter, according to the Commerce Department. And business activity in the Midwest slipped in May, according to the Chicago ISM.

Adding to woes, private-sector jobs growth came in at a disappointingly weak 133,000 from April to May, according to ADP and Macroeconomic Advisors.

The reports come a day ahead of the widely-followed May government jobs. Non-farm payrolls are expected to show a gain of 150,000 in May, according to a Reuters poll, after a small gain of 115,000 new jobs in April, the fewest in six months.

Morgan Stanley [MS Loading... () ![]() ] CEO James Gorman defended his bank’s performance as lead underwriter on Facebook’s public offering, despite waves of criticism from investors and a potential legal review of the deal’s marketing.

] CEO James Gorman defended his bank’s performance as lead underwriter on Facebook’s public offering, despite waves of criticism from investors and a potential legal review of the deal’s marketing.

In addition, the investment bank plans to buy 14 percent more of Smith Barney from Citi [C Loading... () ![]() ] and will begin a 90-day process determine the fair market value of the additional stake.

] and will begin a 90-day process determine the fair market value of the additional stake.

Most retailers posted solid same-store sales gains in May, with chains such as Target [TGT Loading... () ![]() ], TJX [TJX Loading... ()

], TJX [TJX Loading... () ![]() ], and Limited [LTD Loading... ()

], and Limited [LTD Loading... () ![]() ] topping analysts' estimates for the month.

] topping analysts' estimates for the month.

Meanwhile, Costco [COST Loading... () ![]() ], Buckle [BKE Loading... ()

], Buckle [BKE Loading... () ![]() ] and Wet Seal [WTSLA Loading... ()

] and Wet Seal [WTSLA Loading... () ![]() ] all fell short of expectations.

] all fell short of expectations.

Striking workers at a Caterpillar [CAT Loading... () ![]() ] plant in Illinois rejected the company's latest contract offer, an official with the International Association of Machinists and Aerospace Workers said.

] plant in Illinois rejected the company's latest contract offer, an official with the International Association of Machinists and Aerospace Workers said.

Billionaire investor Carl Icahn, who last year failed to get his nominees elected to the board of Forest Laboratories [FRX Loading... () ![]() ], plans to back another slate of directors at the drugmaker's next shareholder meeting, according to a regulatory filing.

], plans to back another slate of directors at the drugmaker's next shareholder meeting, according to a regulatory filing.

Talbots [TLB Loading... () ![]() ] skyrocketed after private equity firm Sycamore Partners said it will acquire the women's clothing chain in a deal worth about $193 million.

] skyrocketed after private equity firm Sycamore Partners said it will acquire the women's clothing chain in a deal worth about $193 million.

Also on the M&A front, Gaylord Entertainment [GET Loading... () ![]() ] rallied after the company said it will sell the Gaylord hotels brand to Marriott International [MAR Loading... ()

] rallied after the company said it will sell the Gaylord hotels brand to Marriott International [MAR Loading... () ![]() ] for $210 million in cash.

] for $210 million in cash.

U.S. Airways Group [LCC Loading... () ![]() ]and private equity firm TPG Capital may team up to bid for American Airlines' parent, AMR, people familiar with the discussions told Reuters.

]and private equity firm TPG Capital may team up to bid for American Airlines' parent, AMR, people familiar with the discussions told Reuters.

Meanwhile, JetBlue [JBLU Loading... () ![]() ] gained after UBS raised its rating on the firm to "buy" from "neutral" and boosted its price target to $8 from $6.

] gained after UBS raised its rating on the firm to "buy" from "neutral" and boosted its price target to $8 from $6.

Joy Global [JOY Loading... () ![]() ] tumbled after the mining equipment maker said it expects order rate to moderate and sales to remain unchanged over the next few quarters.

] tumbled after the mining equipment maker said it expects order rate to moderate and sales to remain unchanged over the next few quarters.

TiVo [TIVO Loading... () ![]() ] slumped after the firm a bigger-than-expected loss and handed in a weak quarterly guidance.

] slumped after the firm a bigger-than-expected loss and handed in a weak quarterly guidance.

—By CNBC’s JeeYeon Park (Follow JeeYeon on Twitter: @JeeYeonParkCNBC)

Coming Up This Week:

FRIDAY: Non-farm payrolls, personal income & outlays, ISM mfg index, construction spending, auto sales, Wal-Mart shareholders mtg

More From CNBC.com:

Asian Stocks, Oil Slump on China Manufacturing; Dollar Advances - Businessweek

Asian stocks tumbled, extending the steepest monthly slide since 2008, U.S. equity futures sank and oil slumped after data showed Chinese manufacturing slowed before a U.S. payrolls report today. The Dollar Index climbed to its highest level since 2010.

The MSCI Asia Pacific Index dropped 1.1 percent as of 10:32 a.m. in Tokyo. The Nikkei 225 Stock Average (NKY) fell 1.1 percent. Standard & Poor’s 500 Index futures slid 0.7 percent. Oil futures in New York sank 0.5 percent, the fourth day of declines. The Dollar Index gained 0.3 percent, while Australia’s currency weakened 0.8 percent against the greenback.

A Chinese purchasing managers’ index today showed manufacturing slowed in May. Claims for U.S. jobless benefits unexpectedly increased and the world’s biggest economy grew less than initially estimated in the first quarter. Europe’s policy makers clashed over steps to stabilize the 17-nation economy and Spanish bond yields approached levels that forced Greece, Ireland and Portugal to seek bailouts.

The MSCI Asia Pacific Index dropped for a third day, led by resources companies. The gauge dropped 10 percent in May, the biggest monthly drop since October 2008. World stock markets lost more than $4 trillion last month.

China’s manufacturing Purchasing Managers’ Index was 50.4 in May, the National Bureau of Statistics and China Federation of Logistics and Purchasing said today. The reading compares with the 52.0 median estimate in a Bloomberg News survey of 27 economists and 53.3 in April. A reading above 50 indicates expansion.

Oil traded at its lowest levels since October on speculation slowing U.S. growth and Europe’s debt crisis will reduce fuel demand as supplies rise. Crude for July delivery declined 0.5 percent to $86.11 a barrel in New York.

To contact the reporter on this story: Jason Clenfield in Tokyo at jclenfield@bloomberg.net

To contact the editor responsible for this story: Darren Boey at dboey@bloomberg.net

No comments:

Post a Comment