Thomson Reuters is the world's largest international multimedia news agency, providing investing news, world news, business news, technology news, headline news, small business news, news alerts, personal finance, stock market, and mutual funds information available on Reuters.com, video, mobile, and interactive television platforms. Thomson Reuters journalists are subject to an Editorial Handbook which requires fair presentation and disclosure of relevant interests.

NYSE and AMEX quotes delayed by at least 20 minutes. Nasdaq delayed by at least 15 minutes. For a complete list of exchanges and delays, please click here.

US stocks cap biggest rally in 2012 - The Age

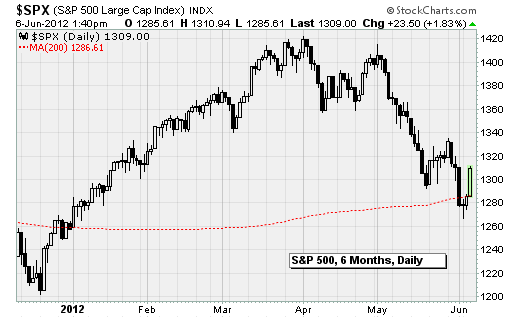

US stocks rallied, giving benchmark indexes their biggest gains in 2012, on speculation global policy makers will take steps to stimulate economic growth.

Bank of America Corp. surged 7.6 per cent to pace gains among financial shares. Caterpillar Inc. and Exxon Mobil Corp. increased at least 3.3 per cent. Home Depot Inc., the largest US home-improvement retailer, climbed 3.4 per cent after raising its stock repurchase plan by $US500 million for fiscal 2012. Facebook Inc. added 3.6 per cent, following a 32 per cent decline since the biggest social-networking company went public.

The Standard & Poor's 500 Index advanced 2.3 per cent to 1,315.13 at 4 p.m. New York time. The Dow Jones Industrial Average increased 286.84 points, or 2.4 per cent, to 12,414.79. About 7.3 billion shares changed hands on US exchanges today, or 8.3 per cent above the three-month average.

"People are viewing central banks as very aware of the weakness of the global economy and looking for ways to deal with that," said Michael Holland, chairman of New York-based Holland & Co. His firm oversees more than $US4 billion. "In addition to that, we've had a major selloff, valuations are low and that certainly helps to lift the market on a day like today."

The S&P 500 rose 2.9 per cent in three days, wiping out the loss driven by a disappointing jobs report on June 1. Earlier this week, the index traded at 12.9 times its companies' reported earnings, according to data compiled by Bloomberg. That was the cheapest valuation in six months, the data showed. Concern about Europe's debt crisis and a global slowdown took the S&P 500 down as much as 9.9 per cent from this year's peak.

Stimulus Bets

Equities rallied today as European Central Bank President Mario Draghi said officials stand ready to act as the euro region's outlook worsens. Federal Reserve Bank of Atlanta President Dennis Lockhart said extending Operation Twist, the program to lengthen maturities of debt on the US central bank's balance sheet, is an "option on the table."

The US economy maintained a moderate pace of growth, according to the Fed's Beige Book survey of business conditions. The policy-setting Federal Open Market Committee meets June 19-20 to consider whether more stimulus is needed.

"I would be surprised if the Federal Reserve isn't already having a contingency plan if everything unravels in Europe," said Ron Florance, managing director of investment strategy for Wells Fargo Private Bank. His firm manages $US169 billion.

Warren Buffett, the billionaire chairman of Berkshire Hathaway Inc., said he expects the US economy to avoid another recession as long as Europe can contain its debt crisis. There won't be a recession "unless events in Europe develop in some way that spills over here big-time," Buffett said yesterday at the Economic Club of Washington, D.C.

Biggest Gains

All 10 groups in the S&P 500 rose today as energy, financial and industrial shares had the biggest gains. The Dow Jones Transportation Average climbed 3 per cent. Bank of America increased 7.6 per cent, the most in the Dow, to $US7.64. Caterpillar, the largest maker of construction equipment, added 3.6 per cent to $US86.66. Exxon Mobil jumped 3.3 per cent to $US80.18.

Home Depot rose 3.4 per cent to $US50.60. The timing of its share repurchases will not have a material impact on the diluted earnings per share in that period, the retailer said.

Monsanto Co. added 3 per cent to $US79.20. The largest seed company will repurchase as much as $US1 billion of shares as rising profit boosts the company's cash hoard to a record.

Facebook rallied 3.6 per cent to $US26.81. No large US company is attracting more attention from short sellers than Facebook amid bets it will keep falling after losing $US29 billion since its initial public offering.

Short Interest

Short interest on the Menlo Park, California-based company reached 5.9 per cent of shares outstanding, according to data compiled by Bloomberg and Data Explorers Ltd., a New York-based research firm. None of the S&P 500 companies with at least $US50 billion in market capitalization has short interest higher than 3 per cent, the data show. Facebook, which has a market value of about $US61.6 billion, isn't in the S&P 500.

"Facebook is one of those companies whose future potential is unknown and unknowable," said Robert Stimpson, a money manager at Akron, Ohio-based Oak Associates Ltd., which oversees about $US900 million and doesn't own Facebook. "The stock is expensive. The short interest might also reflect a bet that there is more bad news to come and Facebook will be punished."

Nasdaq OMX Group Inc.'s board approved a plan to pay brokers whose orders were mishandled in Facebook Inc.'s initial public offering, earmarking about $US40 million to cover losses.

Chesapeake Energy Corp. jumped 7.1 per cent, the most since Aug. 11, to $US18.21. The company is in advanced talks to sell pipelines to Global Infrastructure Partners for more than $US4 billion, said two people with knowledge of the matter.

Unexpected Profit

A measure of homebuilders in S&P indexes gained 3.7 per cent. Hovnanian Enterprises Inc. surged 18 per cent, the most since Aug. 15, to $US2.01. The largest homebuilder in New Jersey reported an unexpected profit for its fiscal second quarter as orders jumped 52 per cent amid rising US demand for new houses.

Iron Mountain Inc. surged 14 per cent, the biggest gain in the S&P 500, to $US32.32. The document-storage company approved a plan to convert to a real-estate investment trust and increased its quarterly dividend by 8 per cent.

Lee Enterprises Inc. soared 16 per cent, the biggest gain since Jan. 24, to $US1.33. Buffett's Berkshire Hathaway disclosed owning a stake in the owner of newspapers in the US Midwest and West Coast.

Ancestry.com Inc. gained 11 per cent to $US25.06. The family- history research website is weighing a sale and working with Frank Quattrone's Qatalyst Partners LLC to find buyers, according to a person with knowledge of the situation.

Material Costs

Halliburton Co. slumped 3.5 per cent to $US28.10. The world's largest provider of hydraulic-fracturing services said North American margins will be 500 to 550 basis points lower this quarter than last because of higher material costs.

Tempur-Pedic International Inc. plunged 49 per cent, the most ever, to $US22.39. The luxury mattress maker cut its full- year profit and revenue forecasts amid lower-than-expected second-quarter sales in North America.

The selloff that erased $US1.78 trillion from US equity values has pushed the cost of options to the highest levels of 2012, prompting hedge funds to add to short sales at the fastest rate since October. The Chicago Board Options Exchange Volatility Index surpassed 26 last week, a level not seen since December.

The gain left the gauge near its price just before the S&P 500 slumped 12 per cent in August and September 2011, data compiled by Bloomberg show. As the VIX has risen, an International Strategy & Investment Group measure of hedge fund bullishness has retreated by 7.4 per cent.

Short Selling

While the cost of hedges and the amount of short selling are increasing, they may have further to go before bearishness is exhausted amid Europe's credit crisis, according to Wayne Lin of Legg Mason Inc. The VIX would have to gain 45 per cent to reach its average price in August and September. The ISI gauge bottomed at 42 last year compared with its level of 45.3 now.

"The concerns about Europe combined with questions about the robustness of global growth are filtering into markets," Lin, who helps oversee $US639 billion as a money manager at Baltimore-based Legg Mason, said yesterday in a phone interview. "These risks make people back out of equities, cause the hedge funds to go short and push the VIX up."

CANADA STOCKS-TSX bounces on commodities, euro zone hopes - Reuters UK

Thomson Reuters is the world's largest international multimedia news agency, providing investing news, world news, business news, technology news, headline news, small business news, news alerts, personal finance, stock market, and mutual funds information available on Reuters.com, video, mobile, and interactive television platforms. Thomson Reuters journalists are subject to an Editorial Handbook which requires fair presentation and disclosure of relevant interests.

NYSE and AMEX quotes delayed by at least 20 minutes. Nasdaq delayed by at least 15 minutes. For a complete list of exchanges and delays, please click here.

How Business School Can Prepare Entrepreneurs for the Startup World - Forbes

Page 2 of 3

Classmates and Faculty Come in Handy for Research

A business school gathers a community of people with similar mindsets and goals, but generally with diverse backgrounds. Thus, business school can be an ideal place for bouncing ideas around and getting feedback from a variety of people.

Both faculty and classmates helped Yudan shape his business idea and provided feedback on strategy, marketing, targeting, and funding he says. “For all of these essential parts of our business, I found advice all within the same school and program,” he says. Within his class alone, classmates were drawn from nearly 60 countries, he says. “I could very easily see if [Flat Club] could scale, because I was talking with my classmates, who were my potential customers from different countries. It also helped me understand the different challenges in various markets.”

For Yudan, business school also became the perfect recruiting ground. Now with 15 employees, Flat Club boasts a number of employees from LBS, including two partners (out of three), some interns, and the majority of its full-time staff. Yudan is also proud of his team’s diversity, as its employees hail from 12 different nationalities.

Flat Club was even able to test its concept within the school before launching publicly. An email was sent to students, and within two weeks the site had 70 apartments listed, says Yudan, adding that the positive response illustrated the business’s potential.

Reputation and Network are Priceless

Business school offers an advantage over incubators or accelerators, Yudan says. Business school graduates forever hold the reputation and alumni network of their alma maters.

“A reputation and network are essential for the success of any startup,” says Yudan. “It’s impossible to reach out to customers, to investors, to clients, without reputation. And the network is what makes that happen.”

Yudan says that the alumni network at LBS has been immeasurably helpful, and he recommends that business school students to connect with alumni when starting companies. “The more I reached out to alumni, the more it helped grow the business,” he says. Even though he had never met many of the alums he contacted, they were tied with their LBS roots, which facilitated an existing bond that helped catalyze action.

For many questions Yudan encounters, he’s been able to ask for advice from former or current LBS students, he says. He uses LBS’s internal social network, called Portal, to post to forums and find relevant contacts. One of the first inquiries he placed, for example, was about what type of insurance he needed to provide for employees. “Within 10 minutes, I had four answers about what type of insurance I needed, which was the cheapest, and who I should contact for further advice.”

Financial Worries Add to Cancer Patients' Burden - US News and World Report

By E.J. Mundell

HealthDay Reporter

WEDNESDAY, June 6 (HealthDay News) -- A small study gives a snapshot into the financial anxieties that plague many patients with advanced cancer and their spouses, even as they struggle against the disease itself.

Four of every five such American patients and their spouses-caregivers in the study said they had concerns about meeting medical costs and suffered "financial stress." Worries about paying medical costs also were tied to lower mental and physical health, the study found.

"Across the board, the longer they were in treatment or reaching the end of life, there were [financial] concerns. There were concerns whether it came to their own well-being or their families' well-being," said study lead author Fay Hlubocky, a clinical psychologist and ethicist at the University of Chicago Pritzker School of Medicine.

She reported the findings this week at the annual meeting of the American Society of Clinical Oncology (ASCO), in Chicago.

The study involved 52 patients with advanced cancers, all of whom were enrolled in clinical trials, and their spouses. While patients in clinical trials are a slightly different group than that seen in the general population (because some expenses of treatment may be paid for), Hlubocky said the numbers from her study "are borne out in the literature generally" for patients battling cancer outside of such trials.

Patients ranged in age from 28 to 78, with a median age of 61. All were married, two-thirds had more than a high school education, and just over half made less than $65,000 a year. Forty-five percent of the patients were employed, as were two-thirds of spouses-caregivers. Each patient and their spouse were asked about a wide range of financial concerns, and they also took part in standard tests assessing depression, anxiety, quality of life and mental/physical health.

The researchers found that at the beginning of the study, 82 percent of the patients and 69 percent of the spouses reported "medical cost concerns," while 79 percent of the patients and 81 percent of spouses said they had "financial stress." Queried a month later, the level of "medical cost concerns" had risen -- 85 percent of patients and 72 percent of spouses now cited such worries.

People who encountered "unexpected" costs related to care had higher anxiety and depression scores than those who did not, the study found. Quality-of-life scores were lower for patients who had financial worries, and the physical and mental health of the spouses-caregivers seemed to decline as medical care cost worries persisted, the study found.

What were patients and their spouses worried about? According to Hlubocky, it ranged from the "little things" -- parking and hotel accommodations, gas and mileage getting to and from doctors' appointments -- to much larger concerns, including insurance coverage (or lack thereof), how to provide for loved ones after death, and even bankruptcy.

Some participants expressed real anxiety in meeting their financial obligations. "We had to pay for an additional hospitalization for a small-bowel obstruction, and insurance would not cover it," one patient told the researchers. "If we had to sell our house to pay, we'd do it."

Other patients felt their illness threatened their livelihood. "My employer has an attendance policy that if violated too many times will result in termination," the patient said. "My appointments have to be midday usually." The patient considered going on disability, "but that would not pay for my insurance."

One expert said these types of fears are all too common for people coping with cancer.

"It is certainly true that the impacts beyond diagnosis and treatment are tremendous for cancer patients," said Dr. Sylvia Adams, ASCO spokeswoman and assistant professor in the department of medicine at NYU Langone Medical Center, in New York City. "They do face several challenges. And as this article shows, there is a substantial number of patients who feel that there is anxiety and depression and lower quality of life associated with worries about financial stability."

Adams said that, even for people with insurance, costs can quickly escalate. These include medication co-pays, transportation costs, time missed from work, child-care issues and the cost of in-home medical devices.

Business as usual for the Royal family as they go straight back to work after Diamond Jubilee triumph - Daily Telegraph

Mr Rajapakse, whose Range Rover did not carry a flag because of security concerns, was jeered by hundreds of Tamils and other human rights campaigners who accuse him of torturing prisoners. He had earlier been forced to cancel a speech to the Commonwealth Economic Forum.

The Queen appeared relaxed about the presence of the protestors as she was handed a bouquet on her arrival by nine-year-old Aduke Badale, the daughter of one of the Secretariat’s staff.

Wearing a floral print silk dress by Stuart Parvin and a blue wool crepe hat, the Queen was welcomed by Mr Sharma, who told the guests: “It gives me great pleasure to welcome you all on this very special day in the history of the Commonwealth.”

The Queen was presented with a plaque on which the leaders expressed their “profound admiration and abiding appreciation for the manner in which Her Majesty has diligently and faithfully served the Commonwealth”.

The lunch was the Queen’s second official engagement of the day, following an audience with the Canadian Prime Minister, Stephen Harper, during which she unveiled a new portrait of herself by the Canadian artist Phil Richards, commissioned by the Government of Canada.

In Scotland the Prince of Wales, or Duke of Rothesay as he is known north of the border, opened the biennial Scotsheep event in the grounds of Dumfries House, the stately home renovated by charities brought together by the Prince in Cumnock, Ayrshire.

Carrying a shepherd’s crook and wearing a flat cap, or bunnet, and black wellies, the Prince told farmers it was “a shame” that he had not been able to visit the previous day, but joked that he had had “a very busy few days”.

He had travelled to Scotland immediately after Tuesday’s Jubilee events and spent the night at Dumfries House before opening the event, which is the flagship show of Scotland’s National Sheep Association.

The Duke of Cambridge was heading back to Anglesey to resume his work with his RAF Search and Rescue Squadron and Prince Harry has returned to his Apache helicopter duties with the Army.

Next week the Queen will resume her round-Britain Diamond Jubilee tour by visiting Nottingham, Lincolnshire Northamptonshire and Hertfordshire.

The Duke of Edinburgh is expected to be out of hospital by then, but will wait for advice from doctors before any decision is made on whether he is well enough to accompany the Queen, as he is scheduled to.

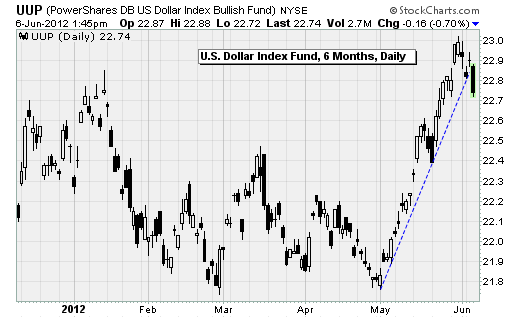

Dollar's drop unleashes stocks, gold - MSN Money

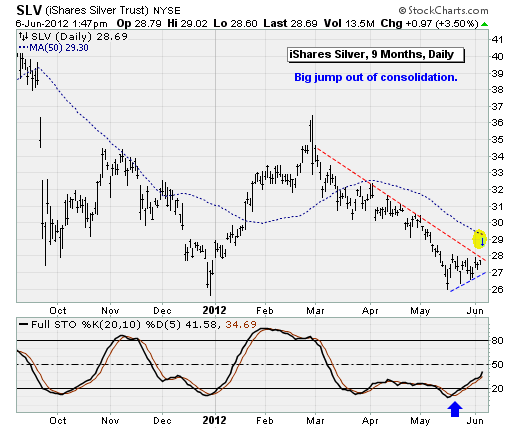

The foreign exchange market, one of the most volatile and unpredictable areas of speculation, continues to drive the fortunes of stocks, commodities and pretty much everything else. With the dollar dropping hard and the euro rising Wednesday on reports that Europe is prepping a way to push capital into Spain's beleaguered banks, risky assets, especially dollar-sensitive precious metals, are blasting higher.

Such are the consequences of a pullback by retail investors and a rising domination of hedge fund types and high-frequency computer trading algorithms. No matter -- we can use it to our advantage.

First, the details. This morning's policy announcement from the European Central Bank was a dud, with no new actions hinted as the institution remains worried about lingering inflationary pressures. But this was eclipsed by multiple reports that Europe is frantically cobbling together a possible solution to the Spanish banking problem. According to RBS estimates, with borrowing costs rising fast, Spain needs nearly $600 billion in assistance just to get it through 2014 as it battles with the legacy of an epic housing bust and bad mortgages.

But Spanish leaders, mindful of their too-big-to-fail status within the eurozone, are pushing back against Germany's insistence that they follow Portugal, Ireland and Spain into the arms of an international bailout administered by the International Monetary Fund, the ECB and the European Union. Instead, Spain wants the E.U. bailout funds to bolster its banks without requesting a formal bailout.

The stalemate seems to be breaking in Madrid's favor.

According to reports, German official believe the bailout funds would be used for direct bank assistance in exchange for a say on executive strategy and management. The kicker is that if it all goes sideways, the home state would be on the hook for any losses. The good news is the assistance would not be added to Spain's sovereign debt levels and could help break the cycle of weak banks, higher government debt, higher sovereign borrowing costs, and even worse banks as their government bonds lose value.

With Europe finally taking constructive steps after a lot of foot dragging, traders are rushing to close extended short-euro/long-dollar trades. And that's benefiting a whole range of assets with gold, silver and the related mining stocks leading the way, as I've been expecting since I warned about the dollar last week. The Edge Letter Sample Portfolio was well positioned for this, with Great Basin Gold (GBG) up more than 21% and the Velocity Shares 3x Silver ETF (USLV) up more than 15%.

New areas of strength include emerging-market stocks and semiconductors. I'm adding new positions in these areas to the portfolio.

The short-euro/long-dollar trade got very extended, so look for this dynamic to continue for at least the next week and a half heading into the next round of Greek elections on June 17. Then we have a G-20 meeting in Mexico on June 18-19. And, finally, a big eurozone summit on June 28-29.

I plan on booking profits and moving largely to cash ahead of those events.

Technically, the S&P 500 has popped back over its 200-day moving average. Normally, a retaking of this oft-cited line of demarcation between bull and bear phases would be considered a sign of strength. But history suggests otherwise.

According to the folks at Sundial Capital Research, since 1928 there have been 19 times when the S&P 500 was above its 200-day for several months, dropped below, then popped up again. Only four of those events went longer than a month before shares dropped back below the 200-day.

On average, it took the index only five days and an additional 0.7% rally before it gave it up and fell away again.

Trading update

Two new, leveraged ETF positions are being added to the Edge Letter Sample Portfolio: The Direxion 3x Emerging Market Bull (EDC) and the Direxion 3x Semiconductor Bull (SOXL). Less aggressive options include the unleveraged iShares Emerging Markets (EEM) and the Market Vectors Semiconductors (SMH).

I am also covering my two regional bank shorts.

Check out Anthony's investment advisory service The Edge. A two-week free trial has been extended to MSN Money readers. Click here to sign up. Contact Anthony at anthony@edgeletter.com and follow him on Twitter at @EdgeLetter. You can view his current stock picks here. Feel free to comment below.

No comments:

Post a Comment