SAN DIEGO, May 30, 2012 /PRNewswire/ -- LPL Financial LLC, the nation's largest independent broker-dealer* and a wholly-owned subsidiary of LPL Investment Holdings Inc. (LPLA), and Retirement Benefits Group™ ("RBG"), a highly specialized retirement plan consulting firm based in San Diego, CA, today announced the continued expansion of Retirement Benefits Group through the addition of five top retirement plan consultants to the firm. The five advisors - Matthew Haerr, Christine Soscia, Amir Arbabi, Peter Littlejohn, and William Brown - will provide retirement guidance to institutional clients in the areas of plan design assistance, compliance updates, and investment due diligence, as well as participant communication and education. These new advisor additions will be based out of the San Diego, CA, Akron, OH, Las Vegas, NV, and Idaho Falls, ID offices of Retirement Benefits Group.

Retirement Benefits Group is supported by the Retirement Partners division of LPL Financial LLC, which is focused on supporting retirement plan-focused advisors.

Darrell Alford, Principal of Retirement Benefits Group, said, "In an increasingly complex retirement landscape for participants, plan sponsors are looking for advisors with fiduciary expertise to help them choose plan structures and investment options that have the potential to offer greater retirement security for their workers. We are proud that Retirement Benefits Group has expanded over the years as a leader in this space by acting as just such a partner to plan sponsors. Our rapid growth continues with the addition of these five leading advisors who have many years of experience in the retirement plan space. With new offices in Idaho and Nevada, we now cover most of the western United States and will continue to expand east, even as we maintain our total focus on providing retirement plan financial advice that is second to none. Equally important, we are delighted to work with LPL Financial Retirement Partners, which has acted as a strong enabling partner in our ongoing growth."

Bill Chetney, Executive Vice President of LPL Financial Retirement Partners, said, "We congratulate Retirement Benefits Group for their continued successful growth as a leading firm within the retirement plan space. We are proud to be an enabling partner to Retirement Benefits Group and other advisor practices focused on this space as they work to help Americans realize their retirement aspirations, and we expect to see strong continued growth in this area."

Matthew Haerr has been a Financial Advisor for over 20 years. He has worked with company sponsored retirement plans, family and personal wealth management, and personal retirement planning throughout his career. Matt has helped business owners and corporations develop strategies for company retirement plans including 401(k), profit sharing and pension plans.

Christine Soscia has been in the financial services industry for over 15 years. She works with business owners in helping design, audit and implement employee benefit programs. Christine also specializes in working with business owners in the areas of strategic tax planning, wealth management, business planning, estate planning and succession planning.

With her primary focus on 401(k) plans, in 2004 Christine was one of the first to graduate from the 401(k) Coach program. In 2006, she purchased a TPA firm and managed more than 160 plans. She has appeared on CNBC and Fox Business and has been quoted in various financial publications. Christine holds Series 63, 7, 24, and 66 registrations with LPL Financial and Life and Health licenses and is a founding member of the Professional Business Advisor group in Las Vegas.

Amir Arbabi assists companies on plan design, fiduciary oversight and investment due diligence. Utilizing his years of experience with retirement planning, Amir creates customized plans to meet his clients' unique goals and needs. In addition to his expertise in plan consulting, Amir has extensive knowledge of wealth and investment management from his training at firms such as Merrill Lynch and Morgan Stanley Smith Barney.

Peter Littlejohn joins the Retirement Benefits Group as the practice leader in the Midwest, currently domiciled in Akron, Ohio. Peter has over 27 years of retirement plan experience, most recently at Highmark Capital Management in San Francisco, where he led the DCIO advisory business beginning in 2009. Earlier he led retirement businesses at Ivy Funds, Wells Fargo, Strong Capital Management and Cigna Retirement and Investment Services, where he was responsible for sales, marketing, client service and strategic development.

About Retirement Benefits Group

Retirement Benefits Group™ ("RBG"), one of the premier retirement plan consulting groups in the country, offers access to brokerage and related retirement-plan services to corporations, governmental agencies, non-profit organizations and their employees through LPL Financial. RBG, which is headquartered in San Diego, CA with additional offices in Irvine, Riverside, Westlake Village, CA, Phoenix, AZ, Gresham, OR, Las Vegas, NV, Idaho Falls, ID, Temecula, CA, Akron, OH, and White Plains, NY, consults on more than $7 billion in retirement plan assets. Visit www.rbgnrp.com for more information.

Financial consultants of RBG are registered representatives with securities offered through LPL Financial, Member FINRA/SIPC. Investment advisory services offered through Retirement Benefits Group, a registered investment advisor and separate entity from LPL Financial.

About LPL Financial

LPL Financial, a wholly-owned subsidiary of LPL Investment Holdings Inc. (LPLA), is the nation's largest independent broker-dealer (based on total revenues, Financial Planning magazine, June 1996-2011), a top RIA custodian, and a leading independent consultant to retirement plans. LPL Financial offers proprietary technology, comprehensive clearing and compliance services, practice management programs and training, and independent research to over 12,900 financial advisors and approximately 680 financial institutions. In addition, LPL Financial supports over 4,400 financial advisors licensed with insurance companies by providing customized clearing, advisory platforms and technology solutions. LPL Financial and its affiliates have approximately 2,700 employees with headquarters in Boston, Charlotte, and San Diego. For more information, please visit www.lpl.com.

*Based on total revenues, Financial Planning magazine, June 1996-2011

LPLA-A

LPL Financial Media Contacts

Joseph Kuo / Chris Clemens

Haven Tower Group LLC

(206) 420-3851 or (206) 420-1525

jkuo@haventower.com or cclemens@haventower.com

RBG Media Contacts

Larry Deatherage

Retirement Benefits Group

(858) 551-4015

ldeatherage@rbgnrp.com

Stocks to watch Tuesday: Starbucks, Layne - Marketwatch

MarketWatch First Take

MarketWatch First Take

MF Global, Corzine may get away with it

Stocks dominated by investor fear - KSAT 12

Worries about a global growth slowdown and uncertainty surrounding Europe's debt crisis kept investors on edge and trading choppy on Monday.

Still, U.S. markets ultimately closed the day not far from where they opened.

"Europe is front and center, back, left and right," said Dan Greenhaus, chief global strategist at BTIG.

Anxieties over the health of the Spanish banking system and the possibility that Greece could soon exit the euro remain high.

"Last week was so terribly negative that even the absence of negative news gives some support to the market," Greenhaus added.

Still it's impossible to ignore the fear factor still gripping the markets as 10-year Treasury yields remain near all-time record lows. That shows that global investors are willing to forego returns simply for the safety of holding debt backed by the U.S. government.

CNNMoney's Fear and Greed Index remained deeply entrenched in extreme fear territory.

There are also worries about slowing growth in emerging markets such as China and India. Recent reports out of China last week showed the manufacturing sector contracted more than expected in May.

The S&P 500 closed flat. The Nasdaq gained 12 points, or 0.5%. The Dow Jones industrial average dropped 17 points, or 0.1%.

Trading was light on both sides of the Atlantic Monday, according to several traders. Investors are wary of making major moves before they know whether central bankers in Europe and the U.S. would consider further stimulus.

Investors are betting that European leaders might be willing to make tough choices to stave off larger problems in the region.

"There's a belief that with their backs against the wall, European leaders will at least come up with a short-term resolution to help the Spanish banking system," said Peter Boockvar, equity strategist at Miller Tabak.

U.S. stocks tumbled more than 2% Friday in the worst trading day of the year. The Dow erased all its gains for 2012, and the S&P 500 and Nasdaq moved into correction territory -- down more than 10% from the year's highs.

Bond prices retreated slightly in Monday trading, allowing the yield on the 10-year note to rise just above 1.5%.

World markets: European stocks closed mixed. The DAX in Germany fell 1.2%, while France's CAC 40 rose 0.1%. British markets were closed for a bank holiday.

Asian markets ended lower in their first day of trading since the U.S. jobs report. The Shanghai Composite tumbled 2.7%, and the Hang Seng in Hong Kong fell 2%. The Nikkei in Tokyo fell 1.7%.

Economy: Factory orders declined 0.6% in April, the government reported Monday. The report was weaker than the 0.1% increase expected by economists surveyed by Briefing.com. The March decline was revised to a deeper 2.1% drop.

Companies: Shares of Facebook, which have gotten hammered since the company's IPO, continued to fall.

Groupon shares dropped more than 7% after falling sharply Friday. The online discount service, which has been dogged with questions about its accounting practices since its initial public offering in November, ended its lock-up period Friday, meaning that insiders who own shares are now able to sell them.

Shares of Chesapeake Energy rose after the embattled natural gas company said it is replacing four members of its board of directors in response to urging from two of its largest shareholders, including Carl Icahn.

Shares of AutoNation, the largest U.S. car dealership, jumped after it reported its May new car sales rose 45%. That was almost twice as good as the 26% rise in industry-wide U.S. car sales reported by major automakers Friday. But the industry-wide sales pace was generally less than forecast, as it was the weakest pace of 2012.

Shares of Starbucks rose after the coffee chain said its top executives would discuss new steps to boost its domestic retail business later Monday.

Research in Motion's stock sank to a low not seen since 2003 amid growing speculation that the BlackBerry maker will soon put itself up for sale.

Currencies and commodities: The dollar rose against the euro and Japanese yen, but fell versus the British pound.

Oil for July delivery gained $1.07 to $84.30 a barrel.

How far down could panic pull stocks? - MSN Money

Panic is in the air. You can see it in the way the S&P 500 has plunged in a big one-day drop below its 200-day moving average -- just as it did before the 1929 and 1987 market crashes. Or in the way the CBOE Volatility Index, a measure of Wall Street's fear, jumped above its 50-day average -- a level associated with significant pullbacks. Or in the way the interest rate on 10-year Treasury notes (1.47%) has dropped to its lowest level ever as investors seek safety in the arms of Uncle Sam -- pushing inflation-adjusted yields deeper into negative territory. The previous record (1.55%) was hit after Thanksgiving 1945.

If people are willing to pay the government for the privilege of investing in T-bonds, you know things are bad. But really, how much downside risk is there for stocks? Let's take a look.

In my last post, I surveyed the economics of our predicament. And they weren't good. Now, from a purely technical perspective, thinks look even worse.

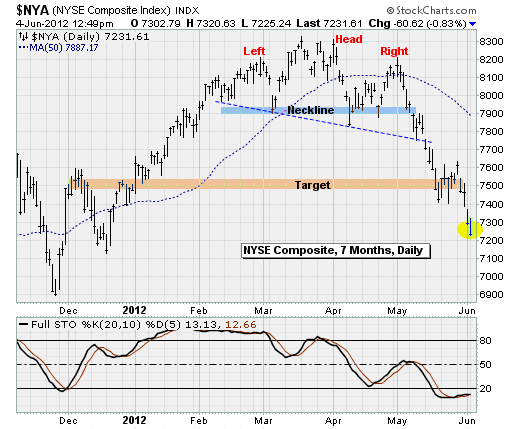

The NYSE Composite has three separate but connected head-and-shoulders reversal patterns in play. They are reflections of the phases of greed, denial and fear that accompany major market tops. The daily chart, shown above, has already seen the pattern fully played out. Formed between February and May, the reversal pattern suggested a target of around 7,500 on the index, a level that acted as a support range late last month.

But now we've fallen through that level, putting the November and December lows in play.

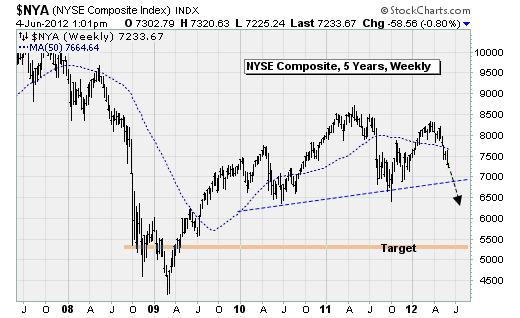

Backing out, the weekly head-and-shoulders reversal pattern that has been forming since the panic over the first Greek bailout back in 2010 is now in play. If the neckline support at around 7,000 fails, which is only a 3% drop from current levels, the new target would be around 5,300. That would be worth a 27% drop from here.

That's not all.

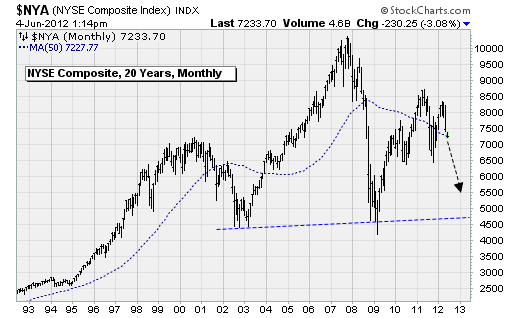

Backing out even more, an epic monthly head-and-shoulders reversal is in play, too, starting when the dot-com bubble burst back in 2000. The shoulders of the pattern aren't perfectly symmetrical, but the 2002-03 and 2009 bear market lows are eerily close. That's the neckline support. And if it's broken, the pattern suggests a price target of minus 1,000 based on the distance from the neckline to the head, which is that 2007 bull market high. Well, let's just call it zero.

Technical analysis is more art than science. There are no hard-and-fast rules, only tendencies. So take this with a grain of salt. But it is worth noting that other long-term indicators -- such as trading volume, fund flow data and cumulative breadth measures -- paint a similarly dark picture.

It won't be a straight shot there. As I discussed Friday, I expect both the Federal Reserve and the European Central Bank, unbounded by falling energy prices and a global growth outlook that's deteriorating quickly, to inject fresh monetary stimulus into the financial markets later this month. That, combined with some type shift by the Germans away from their hardline stance against deeper eurozone integration (via sovereign liability sharing and/or a euro-wide bank deposit insurance scheme) should set off a short-cover rebound rally.

While economics suggest the bounce won't last long, the technicals paint a grim picture of what lies beyond.

Trading update

Selling pressure is currently focusing on the financial sector, and one industry group within it is just now starting to fall out of its February-May topping pattern: regional banks.

There are a plethora of attractive short candidates in the area. I am adding two to my Edge Letter Sample Portfolio: Regions Financial (RF) and Fulton Financial (FULT).

Existing precious-metal positions continue to perform well, with Great Basin Gold (GBG) a standout worth highlighting.

I found both RF and FULT with the help of technical screens developed with Fidelity's Wealth Lab Pro back-testing tools, which you can find here. (Fidelity sponsors the Investor Pro section on MSN Money.)

Disclosure: Anthony has recommended RF short to his newsletter subscribers.

Check out Anthony's investment advisory service The Edge. A two-week free trial has been extended to MSN Money readers. Click here to sign up. Contact Anthony at anthony@edgeletter.com and follow him on Twitter at @EdgeLetter. You can view his current stock picks here. Feel free to comment below.

No comments:

Post a Comment